Shop Now Pay Later with The Affirm Cartridge for Salesforce Commerce Cloud

Written by Manpreet Kaur

Content Writer

February 20, 2023

The usage of pay-over-time applications in the eCommerce domain has increased significantly in the past few years. This payment plan divides the purchase cost into affordable installments with no interest or minimal fees. Customers can buy their desired products and choose to pay conveniently over a period of time using third-party payment solutions. Affirm is one such application that offers pay-over-time options for buyers and enables businesses to increase revenue by empowering customers to buy products and services with flexible payment alternatives.

Why Buy Now Pay Later?

The Buy Now Pay Later payment plans enable shoppers to buy products by delaying instant payments with the help of third-party applications and repaying the original price at a later time with zero or minor fees. Simply put, this payment mode authorizes buyers to own products and services even if they cannot afford them at that point in time. The Buy Now Pay Later benefits businesses and helps them expand their customer base by facilitating them to make instant higher-value purchases.

Buy with Affirm Cartridge

The “Buy with Affirm” cartridge enables customers to purchase products and services from online retailers with merchants who are Affirm partners. It is a closed-end installment loan product by Cross River Bank through Affirm’s technology platform. When users agree to “Buy with Affirm,” Cross River Bank pays the Merchant on their behalf in exchange of the promise to repay the same amount plus a finance charge as per the user’s credit worthiness.

How to Integrate Affirm?

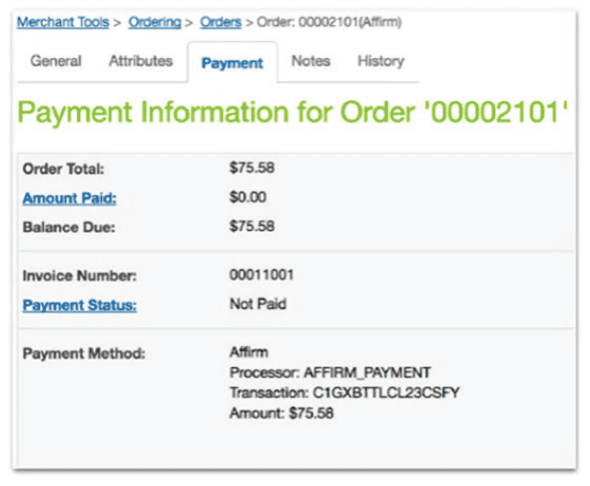

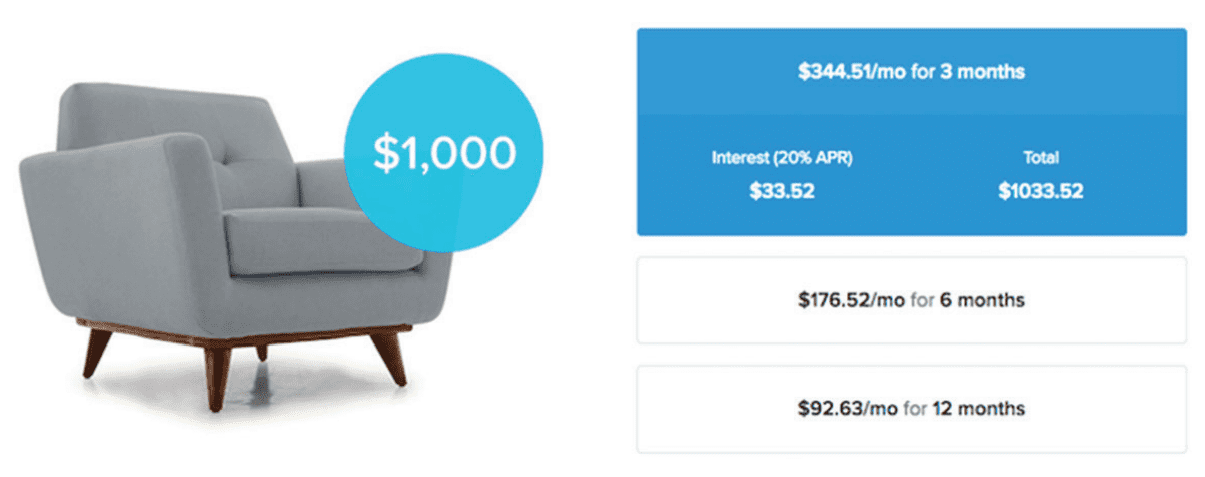

To integrate Affirm, businesses need to get in touch with Affirm for API keys and account setup.The Affirm Cartridge adjusts the payment page to accept Affirm as payment mode. Furthermore, when Affirm is added as a payment gateway, it processes all authorizations, captures, and refunds using Salesforce Commerce Cloud. Also, the Affirm cartridge offers promotional marketing tools to determine and display the monthly payment amounts, depending on the product or shopping basket cost.

Affirm works well with major eCommerce platforms, including Salesforce Commerce Cloud, Shopify, WooCommerce, BigCommerce, Wix, and Stripe.

Features of Affirm Integration

- Go live quickly by seeking immediate integration assistance.

- Enables buyers to purchase desired products conveniently, thereby increasing conversions.

- Delivers transparent consumer financing that suit the needs and preferences of shoppers.

- Offers in-built tools to use top-notch Affirm marketing across all channels.

- Approves order values easily, enhancing revenue and profit.

Use Cases of Affirm Cartridge

Shoppers can use the Affirm cartridge to complete their purchases. Affirm promotions are displayed under monthly payment labels on the PDP, PLP, and Cart pages.

How to Buy with Affirm?

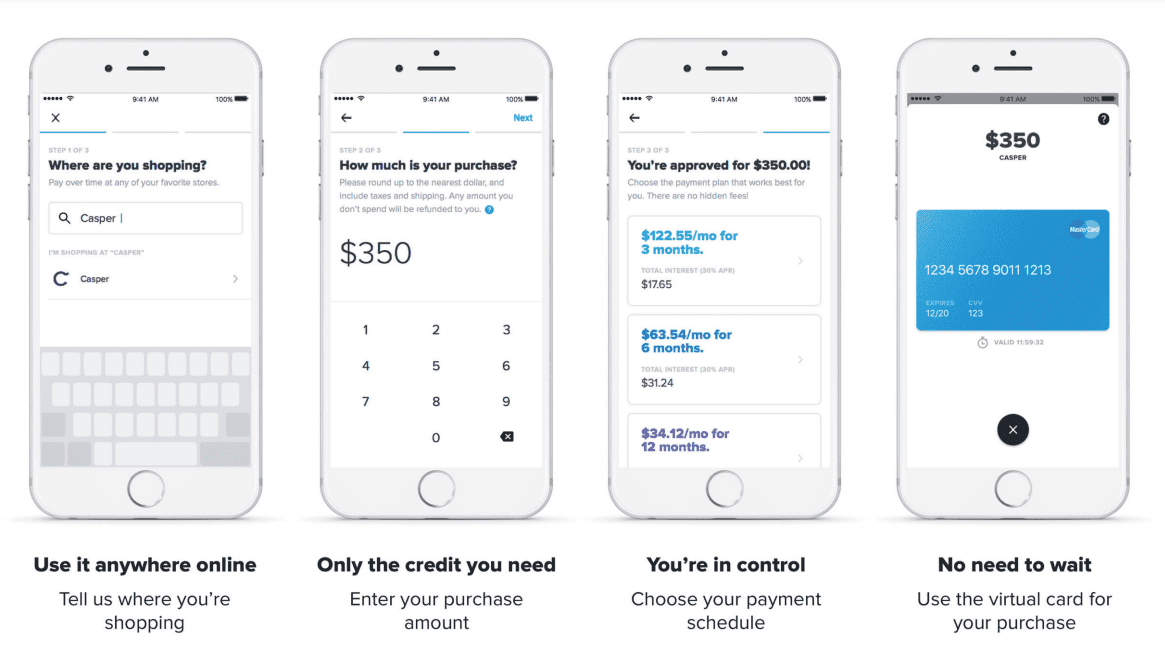

Visit any online or offline store to buy the preferred products and select ‘Pay Later with Affirm’. Customers can either ask for a virtual card on the Affirm App or use Affirm during checkout.

Select the payment options – Affirm Pay in 4 or monthly payments. With Affirm Pay in 4, customers get the freedom to make four interest-free payments every week. This option can be set up easily, is good for frequent purchases, and does not impact the customer’s credit score. The monthly payments option is ideal for expensive deals and does not include any hidden charges.

Lastly, the payment can be made online or through Affirm app. Setting up AutoPay ensures customers do not miss a payment. However, even if a payment is missed, no charges are levied.

How Does Affirm Cartridge Help Businesses?

Increases Average Order Value

Average order value (AOV) measures the total number of orders placed over a specific time interval. Since the pay-over-time applications split the total price into economical instalments, customers do not hesitate to buy expensive items. Also, buyers can upgrade their purchases and shop for what fits their needs more aptly.

Delivers Great Shopping Experiences

When customers experience an exceptional shopping experience with a business, they prefer to buy from them again and also recommend the products and services to others. Customers know how much they can spend and can manage the rest of the payment with the flexible payment options.

Grows Customer Acquisition

Driving new buyers to a website regularly is a tough process. However, with pay-over-time solutions, the probability to get new prospects and convert them is high. Businesses that sell expensive, non-recurring products find it challenging to get more customers. Providing customers with flexible repayment solutions convinces them to buy, thereby expanding the customer base.

Lowers Risks

The eCommerce industry has witnessed many frauds and breaches. With applications such as Affirm, customers provide their commitment to repay over time, reducing the chances of fraudulent transactions and revenue loss for the business.

Boosts Conversions

When customers leave a website without completing the order, it results in a loss of conversion opportunities for the business. The flexibility to pay with budget-friendly repayments lowers the hurdle in the purchasing process and enables the buyers to complete the purchase even if they are on a tight budget.

Speeds Up Purchasing Process

Affirm offers affordable repayments that increase the chances to buy high-priced products, thereby increasing the customer lifetime value and probability of recurring purchases.

Are you looking for assistance with implementing Affirm to deliver pay-over-time solutions for your storefronts? Royal Cyber has certified Salesforce Commerce Cloud professionals who can integrate the Affirm cartridge to help your business grow exponentially. Get in touch with us to explore how you can schedule your payments with Affirm.

Recent Blogs

- Enhance IT security & efficiency with Royal Cyber’s Managed IT Services. Reduce downtime, cut costs …Read More »

- An Insight into ServiceNow Hardware Asset Management (HAM) Ramya Priya Balasubramanian Practice Head ServiceNow Gain …Read More »

- Learn to write effective test cases. Master best practices, templates, and tips to enhance software …Read More »